illinois payroll withholding calculator

Ad Explore ADP For Payroll Benefits Time Talent HR More. Its a self-service tool you can use to complete or adjust your Form W-4 or.

Quarterly Tax Calculator Calculate Estimated Taxes

Box 5400 Carol Stream IL 60197-5400.

. We are trusted by over 900000 businesses provide fast easy payroll options. Affordable Easy-to-Use Try Now. Unemployment Insurance UI supplies funding for the Illinois Department of Employment Security IDES which pays benefits to the unemployed.

Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return. This free easy to use payroll calculator will calculate your take home pay. Illinois State Disbursement Unit PO.

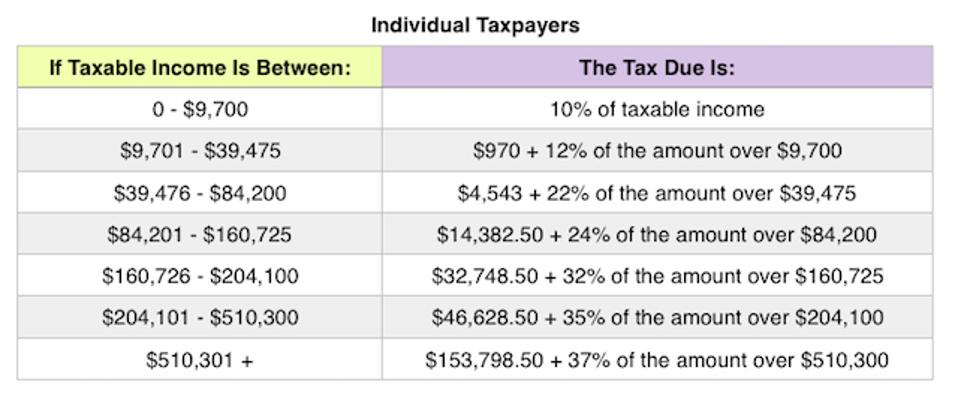

Illinois Payroll Withholding Effective January 1 2022. 2022 Federal Tax Withholding Calculator. 2022 Federal Tax Withholding Calculator.

Our Illinois payroll calculator is designed to help any. Free Federal and Illinois Paycheck. Illinois Hourly Paycheck Calculator.

If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you. We are trusted by over 900000 businesses provide fast easy payroll options. Find 10 Best Payroll Services Systems 2022.

Use ADPs Illinois Paycheck Calculator to calculate net take home pay for either hourly or salary employment. Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return. Youre not the only business owner in Illinois poring over payroll taxes for your hourly employees.

Ad Explore ADP For Payroll Benefits Time Talent HR More. The wage base is. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Box 5400 Carol Stream IL 60197-5400. If would like to change your current withholding please complete a new W-4P and send it to the. If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our.

Compare the Best Now. All amounts are annual unless otherwise noted. Instead you fill out Steps 2 3 and 4.

2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Supports hourly salary income and multiple pay frequencies.

The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income. Calculate your paycheck withholdings for free. Illinois Hourly Payroll Calculator.

2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line. Illinois Withholding Tax Tables Illinois Income Tax withholding at 495 percent 0495 Based on allowances claimed on Form IL-W-4 Illinois Withholding Allowance Certificate Daily Payroll. Just enter in the required info below such as wage.

Additional payroll withholding resources. Enter the amount figured in Step 1 above as the total taxable wages on line 1a of the withholding worksheet that you use. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck.

SERS Contact Information 2101 S. Ad The New Year is the Best Time to Switch to a New Payroll Provider. Youll use your employees IL-W-4 to calculate how much to.

Illinois Hourly Paycheck Calculator. This free easy to use payroll calculator will calculate your take home pay. Free Federal and Illinois Paycheck Withholding Calculator.

This is a projection based on information you provide. Calculates Federal FICA Medicare and.

Nanny Tax Payroll Calculator Gtm Payroll Services

Payroll Calculator Excel Template To Calculate Taxes And Etsy Singapore

Illinois Paycheck Calculator Smartasset

Federal Withholding Calculator Store 53 Off Www Ingeniovirtual Com

Payroll Deductions Calculator For Estonian Companies Enty

Federal Tax Calculator 2019 Sale Online 50 Off Www Ingeniovirtual Com

Free Illinois Payroll Calculator 2022 Il Tax Rates Onpay

Federal Tax Calculator 2019 Sale Online 50 Off Www Ingeniovirtual Com

Paycheck Tax Withholding Calculator For W 4 Tax Planning

How To Calculate Payroll Taxes Methods Examples More

Paycheck Calculator Take Home Pay Calculator

Federal Tax Calculator 2019 Sale Online 50 Off Www Ingeniovirtual Com

Free Illinois Payroll Calculator 2022 Il Tax Rates Onpay

How To Calculate Payroll Taxes Methods Examples More

Tip Tax Calculator Payroll For Tipped Employees Onpay

Bi Weekly Paycheck Calculator Flash Sales 59 Off Www Ingeniovirtual Com

Federal Tax Calculator 2019 Sale Online 50 Off Www Ingeniovirtual Com